For HR leaders, creating the right benefits package is often a balancing act. On one side is the organization’s budget. On the other is the need to provide benefits that employees actually value. Too often, companies overspend on benefits that go unused or cut costs in ways that reduce employee satisfaction and retention. Therefore, it is vital to design employee benefits that cater to both organizational needs and employee preferences.

The challenge is not just offering more, but offering smarter. By focusing on what employees truly need while keeping costs under control, HR teams can design benefits that strengthen both the workforce and the bottom line. Design employee benefits with intention, and you will see an improvement in both satisfaction and retention.

Why Designing Employee Benefits That Balance Cost and Value Matters

Designing employee benefits is more than creating perks. These are tools that impact recruitment, retention, and overall company culture. A strong benefits program can:

- Attract top talent in a competitive market.

- Reduce turnover by improving job satisfaction.

- Boost productivity by easing employee stress.

At the same time, costs are rising. Healthcare premiums, retirement contributions, and wellness programs all add up. HR leaders must show executives that benefits provide measurable value. Design employee benefits that meet these objectives, and balance can be achieved. Without this balance, even well-intentioned programs can create financial strain or fall flat with employees.

Strategies to Design Employee Benefits That Balance Cost and Value

1. Understand What Employees Value Most

Not every benefit is equally important to every workforce. Use surveys, focus groups, or feedback platforms to learn what your employees actually want. Younger employees may prioritize student loan repayment or flexible work options, while more experienced employees may focus on retirement contributions or healthcare. When you design employee benefits around these needs, you increase workforce satisfaction.

2. Evaluate Utilization Rates

If benefits are offered but rarely used, they may not be worth the investment. Regularly review participation data to identify which benefits provide value and which could be replaced or adjusted.

3. Consider Tiered or Flexible Options

A one-size-fits-all package often leads to waste. Instead, offer tiered or customizable options that allow employees to choose what matters most to them. Flexibility ensures higher satisfaction without unnecessary costs.

4. Invest in Preventive and Wellness Programs

While preventive care and wellness initiatives may require upfront investment, they often reduce long-term costs by improving employee health and lowering absenteeism. Examples include mental health resources, fitness stipends, or financial wellness programs.

5. Use Technology to Improve Employee Benefits Design

Benefits administration platforms can reduce overhead by simplifying enrollment, communication, and data tracking. Automation lowers administrative costs and helps employees better understand and use their benefits.

6. Benchmark Against Industry Standards

Compare your offerings with industry peers to ensure your package is competitive but not overextended. Benchmarking helps you identify gaps and avoid overspending on programs that do not align with employee expectations.

The ROI of Smarter Benefits

Balancing cost and value is not about cutting back. It is about designing programs that employees appreciate while showing leadership measurable results. When HR teams succeed, the organization benefits from higher engagement, lower turnover, and stronger recruitment. Thus, design employee benefits with both the employee and the company in mind.

By framing benefits as both an employee need and a business investment, HR leaders can secure executive buy-in and create programs that deliver real impact.

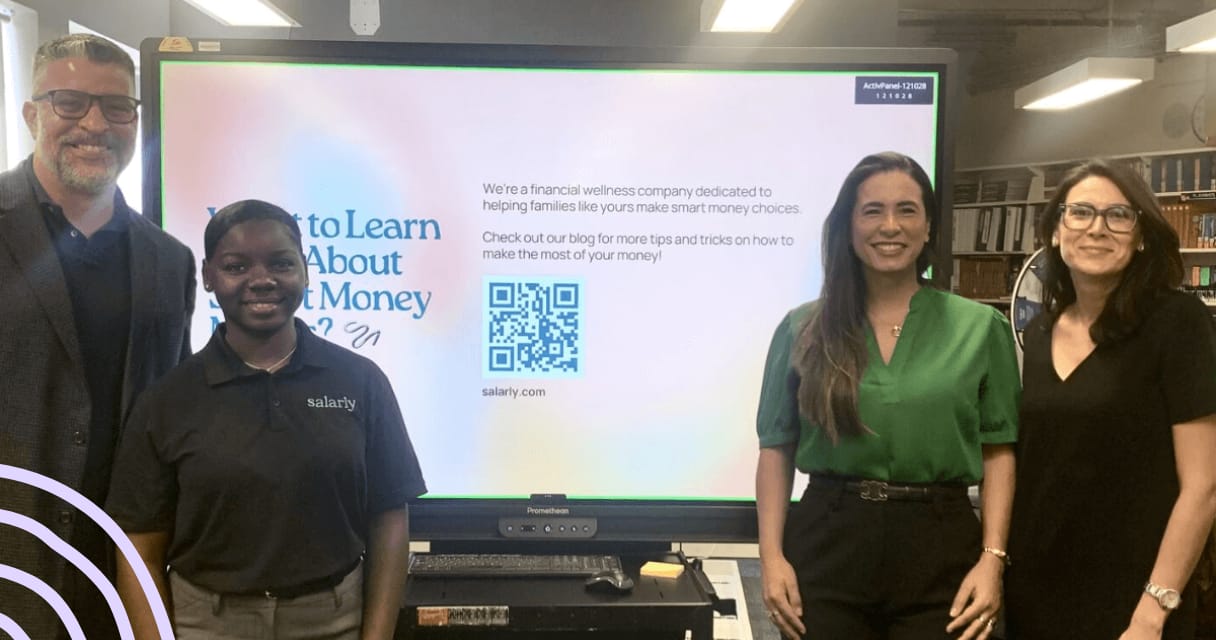

How Salarly Fits In

We created Salarly at Work to help HR leaders offer meaningful benefits without adding cost or complexity. This financial wellness program gives employees access to fair, transparent credit with repayment options that integrate seamlessly with payroll or other flexible methods, depending on their needs.

Our payroll-aligned loans are one solution within Salarly at Work that can improve employee financial stability. Because repayment can align with paychecks, employees gain peace of mind through predictable payments, while companies deliver a benefit that strengthens retention and productivity at no additional expense.

Salarly at Work also provides alternative repayment solutions, giving employees flexibility while keeping the process simple and transparent. Our goal is to help HR teams deliver value-driven benefits that support both employees and the organization.

FAQs: Designing Benefits That Balance Cost and Value

What are the biggest mistakes HR teams make when designing benefits?

A common mistake is offering too many programs without tracking usage. This leads to high costs with little employee impact. Another mistake is failing to align benefits with the workforce’s demographics and priorities.

How can HR measure the ROI of benefits?

Track metrics such as participation rates, employee satisfaction surveys, turnover rates, and healthcare claims data. Comparing these numbers before and after benefit changes provides a clear picture of ROI.

Do flexible benefits packages cost more?

Not necessarily. While there may be initial setup costs, flexible packages often save money in the long run because employees choose the benefits they actually use. This reduces waste and increases perceived value.

How often should HR review benefits programs?

Benefits should be reviewed at least once a year. Regular reviews allow HR teams to adjust offerings based on workforce changes, cost trends, and employee feedback.

Can smaller companies design competitive benefits without overspending?

Yes. Smaller companies can prioritize core benefits such as healthcare, retirement, or financial wellness, then add low-cost perks like flexible work arrangements or recognition programs. The key is to focus on what employees value most. Another example of how companies can support financial wellness is through offering alternatives for repayment solutions, such as payroll linked loans. These are not only effective, but they also do not create additional costs to the employer.