If you are a nurse who relies on overtime to stay financially afloat, you are not alone. Long shifts, inconsistent hours, and unexpected expenses make budgeting feel nearly impossible. But the truth is, with the right approach, you can build a budget that gives you freedom, not stress. Read more for nurse budgeting tips to help you build yours.

Here are five nurse-friendly steps to take control of your finances without depending on overtime.

1. Know Your Base Income: First Nurse Budgeting Tip

Nurses often earn different amounts from week to week. The key is to build your budget using your base income only. That means calculating what you consistently bring home from your regular schedule without including overtime or bonuses. Once you know that number, any additional income becomes a bonus, not a necessity.

Quick tip: Review the last three months of paychecks and take the lowest consistent amount as your starting point.

2. Track Every Expense for One Month

Before you can make a realistic budget, you need to understand where your money is going. For this nurse budgeting tip, you should spend one full month tracking every expense, no matter how small. That includes gas, coffee runs, lunch between shifts, and new scrubs.

Divide your spending into three categories:

- Essentials like rent, groceries, utilities

- Lifestyle choices like streaming services and dining out

- Professional costs like continuing education or nursing license renewals

You may be surprised at how much you can adjust once you see the full picture.

3. Set Small Goals That Match Your Life

Your budget should work with your life, not make it harder. Set one or two clear, realistic goals that matter to you. Whether you want to pay down credit card debt, save for a trip, or build an emergency fund, start with manageable milestones.

Some ideas:

- Set a weekly goal on your saving, be realistic on how much can you start with, then increase it over time

- Pay off one bill completely

- Set aside an emergency fund

These goals give you direction and motivation without requiring overtime shifts just to stay on track.

4. Assign Every Dollar a Purpose

Once you know what is coming in and going out, decide exactly how to use each dollar. This is called zero-based budgeting, and it helps you stay intentional.

Example:

- Rent or mortgage: $1,000

- Groceries: $300

- Loan payment: $150

- Savings: $100

Every dollar should be working for you. This approach helps prevent waste and allows you to focus on the goals that matter most. And if you need extra help cutting down on costs, check out this article on best dupes for nurses, so you can improve your budget without compromising your comfort.

5. Automate and Adjust When Needed

Life as a nurse is already busy. Use automation to make your finances simpler. Set up automatic transfers for savings or bill payments. Adjust your budget as your schedule changes. If you work extra hours, you can use that income as a reward, not a requirement.

Use overtime to boost your savings or pay for something fun, not to cover your regular bills.

Budget Smarter with Salarly: Nurse Budgeting Tips

Salarly supports nurses with financial help that aligns with your paycheck. Our fair payroll linked loans make borrowing simple, with no confusing terms or surprise fees. Payments are deducted directly from your paycheck, so you never miss a due date. It’s 100% online, no paperwork, and loan approvals happen in minutes!

If you are tired of relying on overtime, Salarly can help you build a financial cushion, giving you time to budget and make it last.

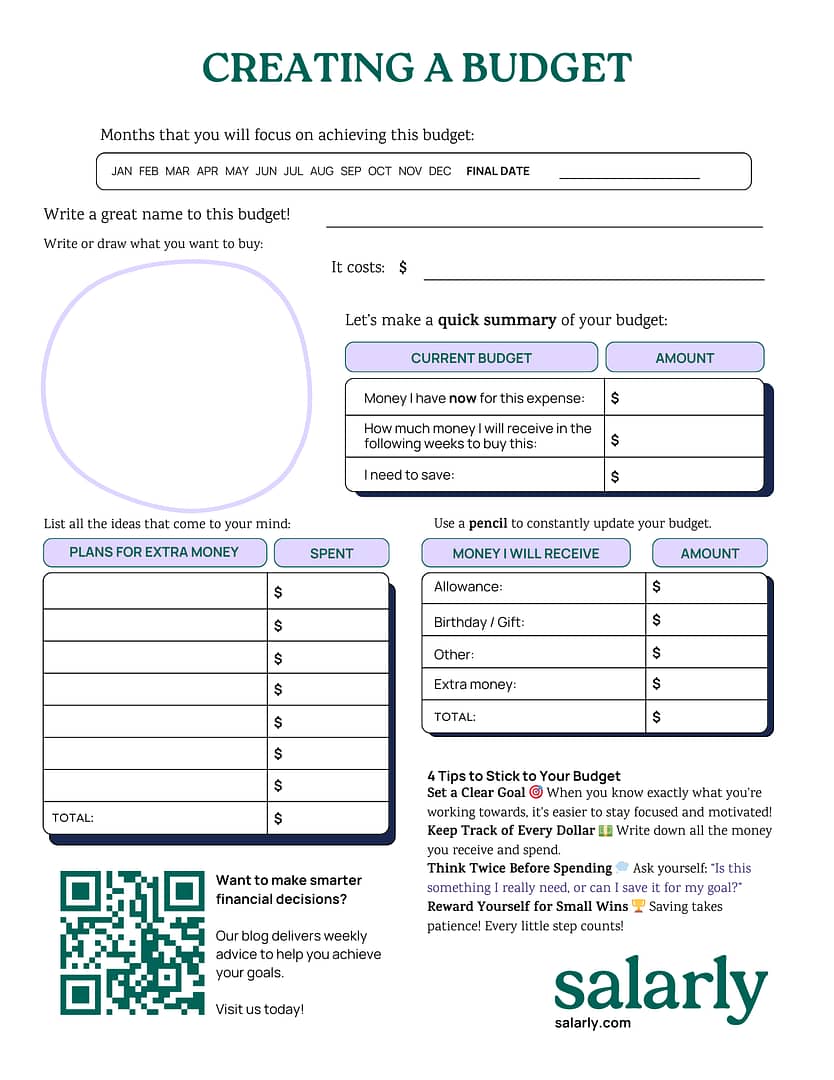

To get started, we have put together a template for you!

FAQs: Budgeting for Nurses

How can nurses stop relying on overtime to cover their bills?

Nurses can stop relying on overtime by creating a budget based on their regular income, not variable earnings. Tracking expenses, setting clear goals, and automating savings can make a big difference.

What is the first step to budgeting for nurses with fluctuating income?

The first step to budgeting for nurses with fluctuating income is to start by identifying your base income. Use only your lowest consistent earnings when building your budget so you are not depending on overtime or bonuses.

How often should I update my budget?

Budgets should be updated regularly, ideally weekly or biweekly. Regular updates help you track progress, adjust for unexpected changes, and stay accountable. Use tools like Salarly’s Budget Planner above, for an organized perspective on what should be updated.

What are some practical ways to generate extra income?

Consider selling items you no longer need, taking on freelance work, or finding part-time gigs. Additionally, Salarly’s payroll linked loans will help you get that necessary boost, and the entire application process can be done online!

What are common mistakes people make when budgeting?

Common mistakes people make when budgeting can be:

- Setting unrealistic goals or timeframes.

- Not accounting for irregular expenses like gifts or travel.

- Failing to track small expenses, which can add up.

- Ignoring progress tracking and adjustments.

- Not taking advantage of streamlined tools such as Salarly loans, that are scheduled in accordance with your payroll frequency.