Payroll-linked loans are designed for convenience, with repayments automatically deducted from your paycheck. But what if you are switching jobs with a payroll loan?

In this guide, we’ll walk you through what happens when you switch jobs with an active payroll-linked loan, what steps to take, and how to keep your repayments on track without stress.

Quick Recap: How Payroll-Linked Loans Work

Payroll-linked loans (also called payroll loans or salary-deducted loans) are personal loans where repayments are directly taken from your wages before you get paid. This ensures consistent, on-time payments and makes managing debt easier. Read more about how these loans work here!

However, these loans are connected to your employer’s payroll system, so a job change impacts how repayments are made.

What Happens When You Change Jobs

When you leave your job while repaying a payroll-linked loan:

- Payroll deductions stop: Your former employer no longer makes loan deductions from your paycheck.

- You switch to direct repayment: You’ll need to pay the lender directly, often through a bank transfer or debit authorization.

- You’re still responsible for the loan: Changing jobs doesn’t cancel the loan or pause payments.

- Your lender may offer options: Some lenders can help set up direct payments or transfer payroll deductions to your new employer (if eligible).

Steps to Take When Switching Jobs with Payroll Loan

✅ Inform your lender right away: Don’t wait. Let them know about your employment change so you can coordinate payments.

✅ Set up direct payments: Make sure there’s no gap in payments between jobs. Your lender will guide you on available methods.

✅ Ask if your new employer participates: If your new employer partners with the lender, payroll deductions might continue seamlessly.

✅ Review your loan terms: Check if your contract includes specific requirements or notices related to job changes.

Can You Transfer Payroll Deductions to a New Employer?

When switching jobs with payroll loan, it depends on your lender and your new employer.

👉 Possible: If your new employer supports payroll-linked loans with the same lender, deductions can often continue without issue.

👉 Otherwise: You’ll continue repayments directly until other arrangements are made or the loan is fully paid.

What If You’re Between Jobs?

If you are switching jobs with payroll loan and you’re not starting a new job right away:

- You’re still obligated to pay: The loan remains active regardless of employment status.

- Contact your lender: Many lenders can offer flexible repayment plans or temporary options if you’re facing financial hardship.

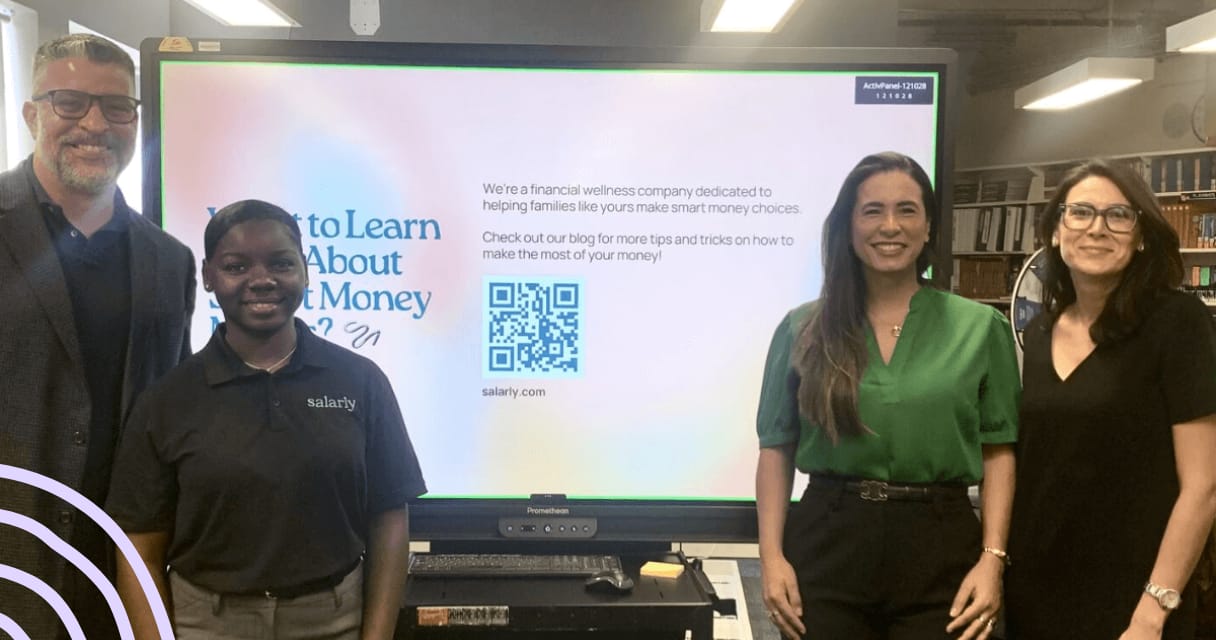

How Salarly Supports You When You Are Switching Jobs with Payroll Loan

At Salarly, we believe in transparency, flexibility, and fairness.

✅ Easy repayment adjustments: If you change jobs, we work with you to quickly shift from payroll deductions to direct payments, so you stay on track without stress.

✅ No hidden fees: There are no surprise penalties for changing jobs. Our priority is helping you maintain your financial health.

✅ Guided support: Our team is always ready to assist you with any concerns.

✅ Financial wellness tools: We provide resources to help you budget and plan during your job transition at blog.salarly.com, so your loan stays manageable while you focus on your next step.

With Salarly, you’re not just taking out a loan, you’re gaining a partner that supports your journey.

FAQs: Switching Jobs with Payroll Loan

What happens to my payroll-linked loan when I change jobs?

Payroll deductions stop, and you must make payments directly until you set up new arrangements with your lender or new employer.

Can I transfer my payroll-linked loan to my new job?

Sometimes, if your new employer partners with the same lender. If not, direct payments will be required.

Will I be penalized for changing jobs?

No, changing jobs doesn’t cause penalties, but failing to keep up with payments can result in late fees or credit impact.

What if I don’t inform my lender that I changed jobs?

Missed payments could occur, leading to fees or collections activity. Always notify your lender promptly.